In the world of business and corporate governance, there are various forms and documents that companies must deal with to ensure compliance and smooth operations. One such document is the CS01 form. If you’re wondering “What is a CS01?” and why it’s important, you’ve come to the right place. This article will provide a detailed explanation of the CS01 form, its purpose, and its significance for businesses.

What is a CS01?

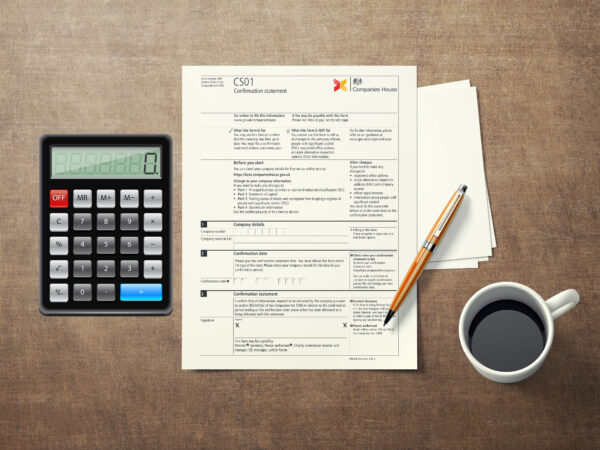

The CS01, also known as the Confirmation Statement, is a mandatory document that companies registered in the UK must file with Companies House. It is a crucial part of maintaining up-to-date records for your business and ensuring compliance with the Companies Act 2006. The CS01 replaces the former annual return and serves as a snapshot of general information about the company at a particular date.

Importance of the CS01 Form

Filing the CS01 form is essential for several reasons:

-

Legal Compliance: Submitting the CS01 is a legal requirement for all companies registered in the UK. Failure to file this document can result in penalties and, ultimately, the company being struck off the register.

-

Transparency: The CS01 ensures that accurate and up-to-date information about the company is available to the public, fostering transparency and trust.

-

Corporate Governance: Regularly updating company information helps in better corporate governance and management, as stakeholders have access to current data about the company’s structure and activities.

Key Information Included in the CS01 Form

The CS01 form includes several critical pieces of information about the company, such as:

- Company Name and Registration Number: Basic identification details of the company.

- Principal Business Activities: A description of the company’s main business activities.

- Shareholder Information: Details of the shareholders, including the number of shares held and their nominal value.

- Directors and Secretaries: Information about the current directors and, if applicable, the company secretary.

- Registered Office Address: The official address of the company, where legal documents can be served.

How to File the CS01 Form

Filing the CS01 form is a straightforward process, but it requires accuracy and attention to detail. Here’s a step-by-step guide:

- Prepare the Information: Gather all necessary information, including updates on shareholders, directors, and business activities.

- Access Companies House Service: Log in to the Companies House online service using your company authentication code.

- Complete the Form: Fill out the CS01 form with the latest information about your company.

- Review and Submit: Double-check all details for accuracy before submitting the form. You can file the form online or via post.

Common Mistakes to Avoid

When filing the CS01 form, it’s important to avoid common errors that can lead to delays or penalties:

- Outdated Information: Ensure all information is current and accurate before submission.

- Missed Deadlines: The CS01 must be filed within 14 days of the review period. Missing this deadline can result in penalties.

- Incorrect Shareholder Details: Double-check shareholder information to avoid discrepancies.

The Role of Professional Services in Filing the CS01 Form

For many business owners, managing the intricacies of corporate compliance can be daunting. This is where professional services come into play. Hiring a company secretary or a corporate services provider can alleviate the burden of filing the CS01 form and ensure that all company records are meticulously maintained.

Benefits of Professional Assistance

-

Expertise: Professional service providers have extensive experience in dealing with Companies House filings and can navigate the process efficiently.

-

Accuracy: Ensuring all details are accurate and up-to-date can be challenging. Professionals can help verify information to avoid errors and potential penalties.

-

Time-Saving: Outsourcing this task allows business owners to focus on core activities, knowing that compliance is handled by experts.

-

Ongoing Support: Many service providers offer ongoing support and reminders for future filings, ensuring you never miss a deadline.

Frequently Asked Questions About the CS01 Form

To further assist you, here are some frequently asked questions about the CS01 form:

1. How often do I need to file the CS01 form?

You need to file the CS01 form annually, within 14 days of the review period. The review period is typically 12 months after the company’s incorporation or the date of the last CS01 submission.

2. What happens if I don’t file the CS01 form on time?

Failing to file the CS01 form on time can result in fines and penalties. Persistent non-compliance can lead to the company being struck off the register by Companies House.

3. Can I update other company details when filing the CS01?

Yes, you can update various details such as the company’s SIC code (describing the nature of business), shareholder information, and registered office address while filing the CS01.

4. Is there a fee for filing the CS01 form?

There is a small fee for filing the CS01 form online, which is generally lower than the fee for filing a paper form. The exact fee may vary, so it’s best to check the current rates on the Companies House website.

5. Can I file the CS01 form myself?

Yes, you can file the CS01 form yourself using the Companies House online service. However, many businesses opt to use professional services to ensure accuracy and compliance.

Conclusion

The CS01 form, or Confirmation Statement, is a fundamental requirement for companies registered in the UK. It ensures that essential information about the company is kept current and available to the public. By understanding what the CS01 form is and how to file it correctly, business owners can maintain good standing with Companies House and avoid unnecessary penalties.

Whether you choose to handle the filing process yourself or hire a professional, staying compliant with the CS01 requirements is crucial. It’s not just about fulfilling a legal obligation—it’s about fostering transparency, trust, and sound corporate governance.